UK tax crunch widely expected

£394bn deficit means tax rises will be necessary to pay off coronavirus costs

£394bn deficit means tax rises will be necessary to pay off coronavirus costs

UK tax increases will begin in April and continue for at least the following two years, agree consultants and researchers.

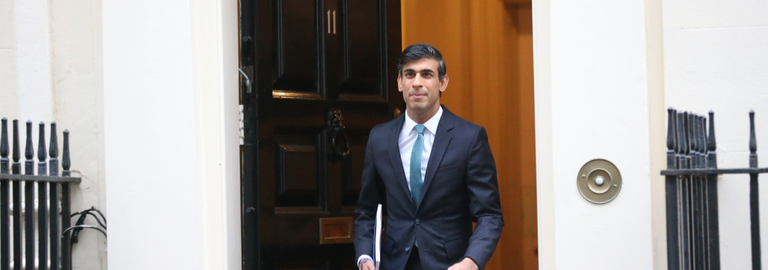

Tackling the pandemic has led chancellor Rishi Sunak to borrow an extra £280bn, bringing the national deficit to nearly £400bn, the highest ever peacetime total.

“The scale of the 2020/21 coronavirus costs means that tax increases are inevitable,” said RSM tax consultant George Bull. “It is most likely that we will see the first of these announced in the Spring Budget with tax rate changes likely to take effect from April 2021. More tax increases can be expected in April 2022.”

Figures announced by Sunak in the Winter Spending Review also revealed that the UK economy will contract by 11.3 percent this year, the worst fall in over 300 years. Unemployment is also expected to reach 7.5 percent by spring 2021, accounting for 2.6 million.

Institute for Fiscal Studies (IFS) director Paul Johnson pointed out that the tax hikes were already in motion, with Sunak providing local authorities with the option to increase council tax by five percent.

“The chancellor has chosen to reduce support to local authorities and has given them the ability to raise council tax by five percent instead. If they do, and they’ll mostly probably need to, that will increase annual tax bills by an average of around £70 per household,” he said.

Accountancy Age reported in September that former UK chancellor, Philip Hammond expected the government to refrain from any “significant” tax rises until after the 2024 general election, but the eye-watering borrowing figures put that into doubt, according to Bull.

“It was widely anticipated that UK borrowing would continue to increase until vaccinations had been administered and the coronavirus brought under control. What has come as a great surprise is to see that UK borrowing is projected to continue increasing, at least until 2025/26. This suggests that recent comments by the Bank of England governor Andrew Bailey, to the effect that Brexit will be more expensive for the UK than the coronavirus, have a lot of truth in them,” said Bull.

Prime Minister Boris Johnson had vowed there would be no return to austerity under his leadership back in June, but IFS director Johnson called the spending review “pretty austere”.

“It cut non-Covid related public service spending by more than £10bn next year, and in subsequent years, relative to plans. It is not obvious that either the need or the appetite for public spending has diminished since March. There has been no top up to NHS spending plans after next year. Frankly, I would be most surprised if these plans were adhered to,” he added.

Johnson added that the chancellor’s plans include a gamble that coronavirus-related spending will cease after 2021, while the increase in universal credit is expected to end by April.

The IFS director said his “central scenario” would be one percent higher than national income in 2024/25 meaning that there would have to eventually be a “two percent of national income fiscal tightening – about £40bn in today’s terms”.

There was disappointment among those in self-employment that the chancellor did not mention any specific support for them in the spending review, with Qdos CEO, Seb Maley calling it a “missed opportunity”.

“The Chancellor didn’t even acknowledge the gaps in the coronavirus support in his speech, despite mounting pressure to tailor the help available. I find it remarkable that the government continues to ignore calls to provide millions of freelancers and small business owners with the support they clearly need,” he said in an email.

Robert Salter, director of tax and advisory firm Blick Rothenburg was also disappointed not to see much in the way of support for small business or any recognition of how Brexit might further impact the public finances.

“It is sad to notice that the chancellor has not mentioned Brexit in his speech – despite the problems this will cause to the British economy and the very real additional costs that will arise for British firms in a number of areas,” he said.

“There appears to be little obvious support in the plans for small businesses and the self-employed, especially as one has to assume that the great majority of the capital expenditure will be awarded to larger businesses,” Salter added.