MTD in Practice: Early lessons for HMRC and accountants

What 100 real businesses—and a room full of accountants—are teaching HMRC about Making Tax Digital.

What 100 real businesses—and a room full of accountants—are teaching HMRC about Making Tax Digital.

With fewer than 200 working days remaining before the phased rollout of Making Tax Digital for Income Tax Self-Assessment (MTD for ITSA), industry stakeholders gathered in central London for a progress check rooted in real-world testing.

Hosted by software provider FreeAgent, the event brought together accountants, policymakers, and vendor partners to discuss early insights from a live pilot involving over 100 landlord and sole trader businesses.

Among the speakers were Exchequer Secretary to the Treasury James Murray MP, HMRC’s Craig Ogilvie, and representatives from accounting firms Gorilla Accounting, Maslins, and Gravita, who offered practical perspectives on preparing clients for compliance.

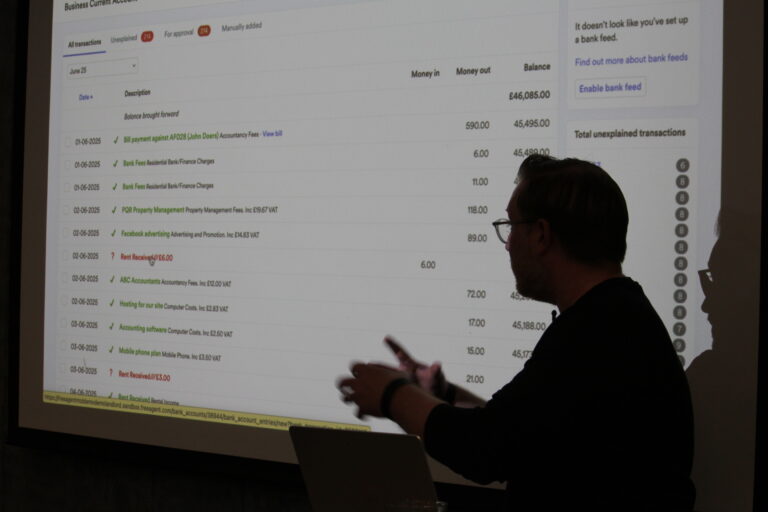

At the heart of the event was a live demonstration of MTD-compatible tools already in use.

The system presented allowed businesses to automate regular admin tasks, view quarterly tax obligations, and submit live updates via HMRC’s sandbox environment.

The pilot revealed that once users are engaged with digital tools, confidence in managing MTD obligations tends to rise.

According to FreeAgent’s own figures, participating businesses reported a 65.7% confidence rating in their MTD readiness—higher than the estimated 25% across the broader small business community.

Features such as transaction categorisation and real-time receipt processing were designed to reduce friction for smaller business users, particularly those without dedicated finance support.

For landlords, tools to manage income splits and global ownership structures were flagged as particularly useful.

However, attendees emphasised that technical functionality alone will not be enough to ensure readiness. Education and clear messaging are equally vital—especially for clients who may not see themselves as ‘businesses’ or be aware they fall within the MTD threshold.

During the panel discussion, several participants raised concerns around inconsistent messaging.

Courtney-Jade Warburton from Gorilla Accounting highlighted that many clients remain unclear on the requirements: “They don’t necessarily understand why quarterly updates are needed, or what counts as qualifying income,” she noted.

There was consensus that a more aligned approach to communications—between HMRC, software vendors, and accountancy firms—will be essential in the months ahead.

Gareth Shaw from Maslins added that simply repeating technical requirements isn’t enough. “You need practical language. And you need consistency.”

James Murray MP acknowledged these challenges in his remarks, stating that HMRC is open to further input and iteration. “We all want to make this a success,” he said. “That means working together, listening, and adjusting as we go.”

The event closed with a call for wider testing and a recognition that repetition will play a necessary role in building national awareness. As one speaker put it: “When you’re sick of saying it, that’s usually when people start hearing it.”

The pilot programme is expected to expand in the coming months.

With the April 2026 deadline looming, accounting firms, software providers, and HMRC alike will need to continue refining both the tools and the messaging that support MTD for ITSA—ensuring that all types of taxpayers, from landlords to sole traders, are not just informed, but equipped.