The tax gap widens with middle earners left to fill the void

The UK’s income tax landscape is shifting, with the wealthiest earners contributing less while middle-income groups see their tax burden rise.

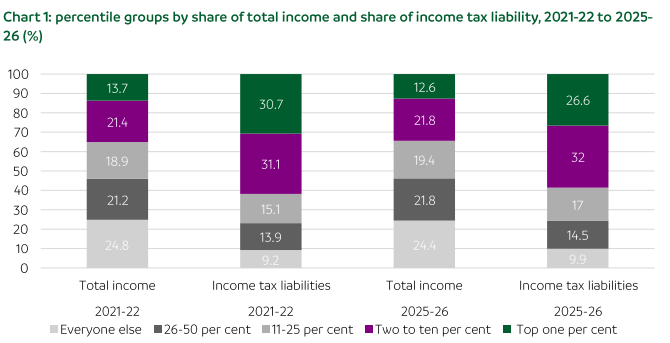

According to recent data from the TaxPayers’ Alliance (TPA), the top 1% of earners are expected to pay just 26.6% of the nation’s income tax in 2025-26, down from 30.7% in 2021-22.

This change marks a significant shift in the distribution of the tax burden, with middle England now facing a larger share of the load.

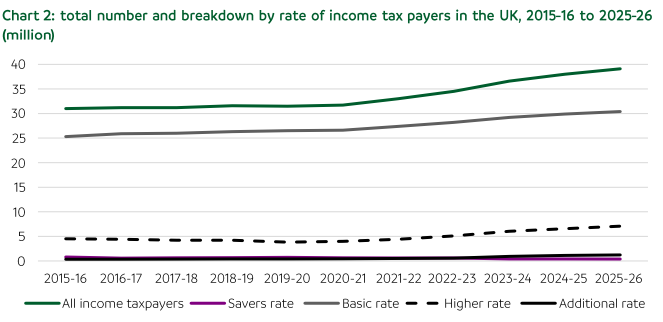

As the tax burden on high earners falls, the number of people paying income tax continues to climb. Nearly 2.9 million additional people will pay the basic rate in 2025-26, and over 2.6 million more will pay the higher rate.

This rise in taxpayers reflects the impact of frozen tax thresholds, which have been in place for several years, and suggests a growing reliance on the middle-income earners to fill the widening fiscal gap.

The regional distribution of these shifts tells a compelling story. Yorkshire and the Humber is expected to see a 20% increase in the number of income taxpayers by 2025-26, despite having some of the lowest average earnings in the country.

Meanwhile, the South East, traditionally a wealthier region, is forecast to add over 830,000 new taxpayers, highlighting the nationwide nature of this trend.

While these numbers may suggest a broadening tax base, they also underscore the changing dynamics of the UK economy.

The wealthiest are gradually pulling back, with many choosing to leave the UK altogether. This exodus is tied to policies aimed at targeting high earners, which have arguably made the UK less attractive to those with the financial means to relocate.

The impact of these policies is not just financial but psychological, as they send a signal that success may be penalised rather than celebrated.

The growing share of income tax borne by middle earners comes as the UK grapples with its fiscal challenges. With inflation and global economic uncertainty adding strain, the government faces mounting pressure to raise taxes.

The National Institute of Economic and Social Research has suggested that up to £50 billion could be needed to meet fiscal targets, which would likely involve increased council taxes and frozen tax thresholds.

John O’Connell, Chief Executive of the TaxPayers’ Alliance, argues that the government’s policies are pushing high earners out of the UK and shifting the tax burden onto those less equipped to absorb it.

“The UK is now trapped in a doom loop,” O’Connell said, adding that the government must rethink its approach to taxation. “This is the inevitable result of an assortment of anti-affluence tax policies.”

As the UK approaches a critical juncture, it will need to address these shifting dynamics. A fundamental reassessment of the country’s tax policies is necessary, not just to ensure the sustainability of public finances but to encourage a climate where wealth and success are not penalised.

Balancing the need for tax revenue with the desire to attract and retain high earners will be a delicate challenge for the government in the years ahead.