The UK economy in 2025: Resilient or running on empty?

The UK has entered 2025 at a crossroads. While global growth is set to continue at a modest pace, Britain faces a far more delicate balancing act. With GDP growth forecasts hovering at 1.3% for the year—a downgrade from earlier projections—the economy remains fragile.

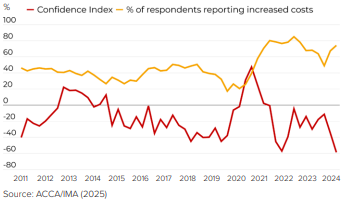

Business confidence has slumped to its lowest level on record, according to ACCA’s annual global economic outlook, and the horizon is clouded by rising fiscal pressures, weak investment, and external trade risks.

The good news? A recession seems unlikely.

The bad news? The UK’s recovery is sluggish, and looming headwinds—from a weakening Eurozone to the potential economic spillover of US trade policies—could derail fragile progress.

ACCA’s annual global economic outlook

Economic uncertainty is taking a toll on UK businesses. The final quarter of 2024 saw a mere 0.1% GDP growth, with the Bank of England forecasting zero growth for Q4.

While real incomes have improved thanks to cooling inflation, businesses are reluctant to invest, spooked by rising costs and a lack of clear policy direction.

Fiscal policy has offered some relief, with the government easing its contractionary stance following the October 2024 Budget. However, a significant rise in National Insurance contributions for employers has dampened hiring intentions, squeezing businesses already struggling with rising operating costs.

The UK’s trade position remains precarious, particularly as US policy shifts could impact global supply chains. President Trump’s proposed tariffs of up to 60% on Chinese imports could trigger retaliatory measures, potentially diverting exports to European markets at a time when the Eurozone’s growth forecast sits at a meagre 1.0%.

For UK firms, this means added pressure on trade volumes, especially in manufacturing, financial services, and automotive sectors.

With a general election expected later this year, businesses are bracing for policy uncertainty. The government’s fiscal stance could shift dramatically depending on the election outcome, adding another layer of unpredictability to an already volatile environment.

Meanwhile, trade frictions remain unresolved. The UK’s relationship with the EU continues to be shaped by regulatory divergence and disputes over financial services access.

While trade deals with India and the Gulf states present growth opportunities, exporters remain highly exposed to fluctuations in global demand.

A major unknown is whether the Trump administration’s protectionist stance will lead to broader shifts in global trade. US tariffs on Chinese goods could push surplus exports into the UK and Europe, creating downward pressure on prices but also intensifying competition for British manufacturers.

Beyond the headline economic figures, three key shifts will define the UK’s business environment this year:

The AI boom is far from over, but 2025 is shaping up to be a year of practical integration rather than breakthrough innovation. UK businesses are are moving beyond AI chatbots and basic automation, increasingly looking at AI-driven decision-making and process optimisation, but regulatory uncertainty and data privacy concerns could slow adoption.

According to the report, the real productivity gains from AI will depend on how well businesses integrate hybrid AI models rather than relying solely on generative AI tools. However, governance challenges remain, especially with the EU AI Act coming into force.

The UK’s climate commitments are under increasing pressure as economic concerns take precedence over long-term sustainability goals. The retreat from aggressive net-zero policies mirrors a global trend, with the US rolling back green incentives and six major banks exiting net-zero alliances in early 2025.

Despite this, investment in renewables remains strong, driven by private sector demand rather than government mandates. The real test will be whether UK businesses continue their sustainability efforts independently, even as political momentum weakens.

The world is moving further away from globalisation, and UK supply chains are being reconfigured in response. The ongoing shift away from China as a manufacturing hub presents opportunities for UK-based production, but industries reliant on semiconductor, pharmaceutical, and EV component imports face continued disruptions.

At the same time, tightening immigration policies—both in the UK and US—could exacerbate labour shortages in critical sectors, particularly healthcare, logistics, and technology.

UK financial leaders are approaching 2025 with a measured mix of caution and pragmatism. According to ACCA’s global survey:

The UK economy is not in crisis, but neither is it thriving. With GDP growth expected at 1.3%, the UK is treading water rather than accelerating. Businesses must navigate shifting trade policies, political uncertainty, and technological disruption, all while preparing for a potential fiscal tightening later in the year.

For some, 2025 will be a year of consolidation—holding steady amid policy and economic uncertainty. For others, it will be a year of adaptation—leveraging AI, reassessing supply chains, and finding new markets to counter risks at home.

Either way, business as usual is no longer an option. The winners this year will be those who move quickly, think globally, and adapt relentlessly.