Everything you need to know about Making Tax Digital for VAT

As the VAT deadline approaches, accountants must become MTD experts, ready to help their clients comply with the new tax system and stay abreast of updates

As the VAT deadline approaches, accountants must become MTD experts, ready to help their clients comply with the new tax system and stay abreast of updates

In Partnership With

With only eight months to go until the Making Tax Digital for VAT deadline, most businesses above the £85,000 threshold are underway with integrating the new digital tax system into their processes.

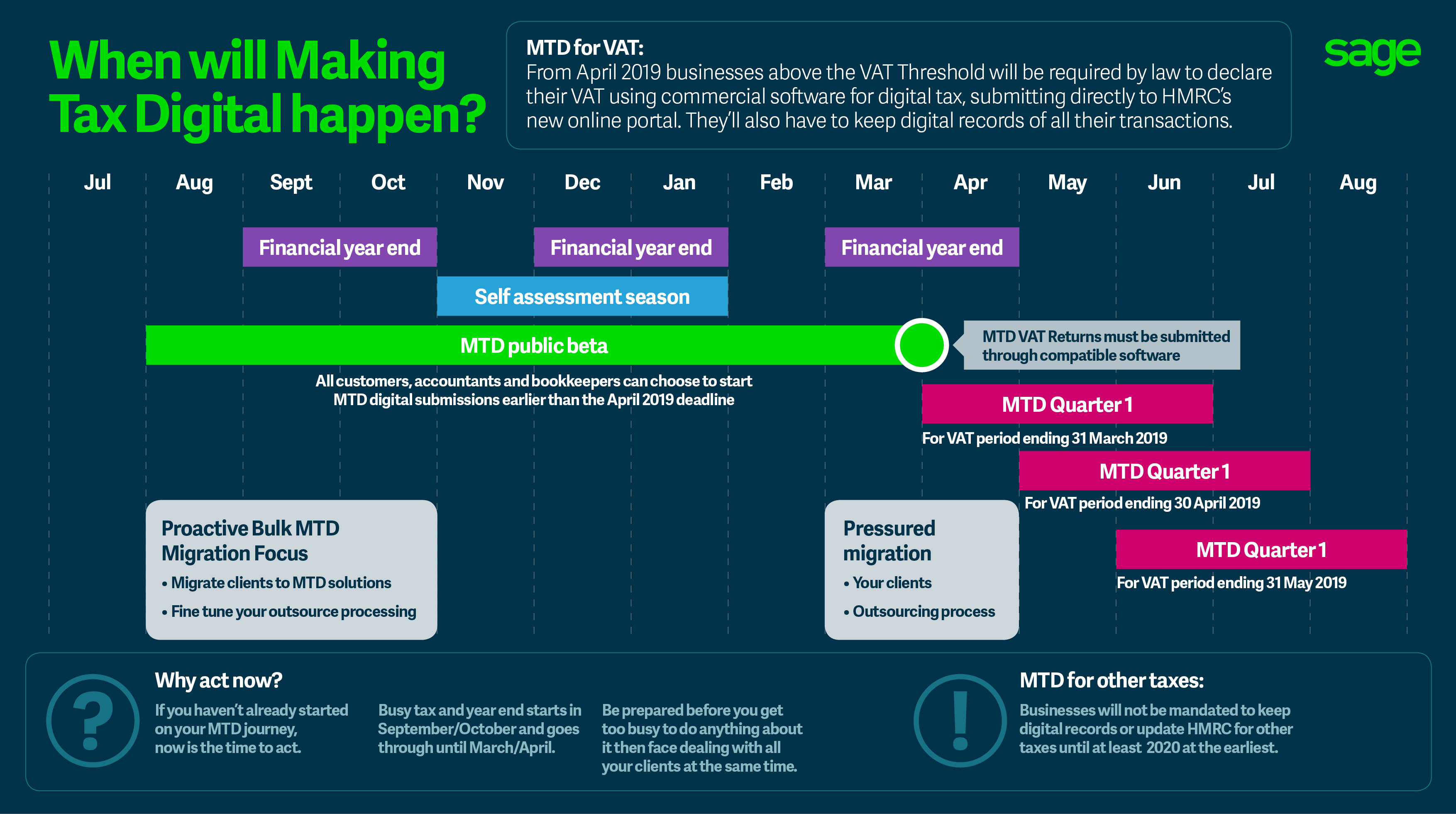

After deciding to delay the MTD for VAT deadline back in July last year, the government finally set a new deadline of April 2019. All other taxes will be April 2020 at the earliest.

Since the new deadline was announced, businesses above the VAT threshold have been getting ready for HMRC’s new system at various paces. All customers, accountants, and bookkeepers can now choose to start their MTD digital submissions early by taking part in the public beta.

It is highly advised that businesses who have not started the transition do so now before the busy tax year starts up again in September/October and other commitments get in the way of a smooth move over to the new way of doing things.

What role does an accountant have to play in MTD? They must become experts. Clients will look to them to explain how it will work, recommend software, help them onboard the new system, and to stay abreast of any changes and updates the government might make.

The above infographic outlines the key elements of MTD and provides a detailed timeline, including the dates you need to be aware of.

To read more about how you can be ready for MTD as an accountant, including what software solutions are available, visit the Making Tax Digital hub.

More about:

The numbers you crunch tell a story. Your expertis...

7yEmbracing user-friendly AP systems can turn the tide, streamlining workflows, enhancing compliance, and opening doors to early payment discounts. Read...

View articleOrganisations can enhance their financial operations' efficiency, accuracy, and responsiveness by adopting platforms that offer them self-service cust...

View articleIn a world of instant results and automated workloads, the potential for AP to drive insights and transform results is enormous. But, if you’re still ...

View resourceDiscover how AP dashboards can transform your business by enhancing efficiency and accuracy in tracking key metrics, as revealed by the latest insight...

View articleThe accounting industry is at a pivotal juncture. Technology is broadening its parameters, but also burdening accountants who need to rapidly upskill ...

View articleHMRC anticipates that 2.9 million individuals with self-employment or property income will join Making Tax Digital between 2026 and 2028. Uptake will ...

View articleWith the countdown to Making Tax Digital for Income Tax officially underway, UK accountants face both challenge and opportunity. Find out what firms m...

View articleFreeAgent has introduced a significant update to its platform, aimed at simplifying the management of the Construction Industry Scheme (CIS) for contr...

View articleMaking Tax Digital for Income Tax will reshape reporting from April 2026. Here’s what accountants need to know: thresholds, deadlines, and preparation...

View articleHMRC has officially ruled out plans to introduce Making Tax Digital for Corporation Tax, confirming the shift in its July 2025 Transformation Roadmap....

View articleHow to choose the right stack to navigate Making Tax Digital. Read More...

View articleWhat 100 real businesses—and a room full of accountants—are teaching HMRC about Making Tax Digital. Read More...

View article