COP27: ISSB advances global climate disclosure baseline mission with fresh partnerships

The standard setter claims the move will stimulate a push to create a globally-comparable framework

The standard setter claims the move will stimulate a push to create a globally-comparable framework

The International Sustainability Standards Board (ISSB) has launched a new global ‘Partnership Framework’ in an attempt to edge closer to the global implementation of climate-related disclosure standards.

In a statement, the ISSB said the framework aims to build capacity in developing and emerging economies, and ultimately assist in the development of a “truly” global baseline of climate disclosure standards.

The partnership is formed of more than 20 member organisations, including ACCA, Deloitte, the UN Development Programme, EY, and the European Accounting Association.

“As we’ve heard from stakeholders […], the need for climate-related financial disclosures is increasingly urgent,” said ISSB chair Emmanuel Faber, announcing the new initiative at the COP27 climate change summit in Egypt.

“We are working collaboratively towards the implementation of effective sustainability disclosures for capital markets, which will empower market participants with the right information to support better economic and investment decision making.”

There is a “particular need” to consider the circumstances of smaller entities and economies throughout this process, the ISSB added in its statement.

Jingdong Hua, the ISSB’s vice chair noted that by making capacity building an “integral part” of the standard-setters mission, they were “committed” to working with partners to ensure “accelerated readiness” to adopt ISSB standards.

This was especially true for in developing and emerging market countries, he said.

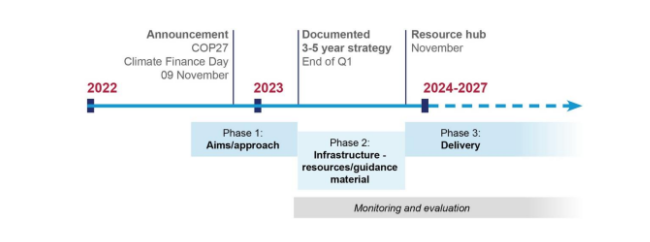

Alongside the announcement, the ISSB released report which detailed the Framework’s intentions alongside a phased, five-year timeline for the implementation of its standards.

Phase one, which is due to run until April 2023, will focus on the establishment of the “aims and approach”, the report says.

Phase two, due to take place between April and November 2023, will focus on the establishment of global “infrastructure”, including resources and guidance material.

The final phase, due to run from November 2023 to 2027, will be dedicated to “delivery”. During this period, the ISSB will aim to “secure high-quality adoption of the ISSB global baseline”.

“Capacity building, including education and skills development, is an important consideration, as companies get ready to adopt the standards,” said Veronica Poole, corporate reporting leader at Deloitte, one of the organisations included in the partnership initiative.

“To achieve a global baseline, it is essential to bring the ISSB’s standards into jurisdictional requirements around the world.”

The new partnership framework closely follows the one-year anniversary of the ISSB’s inception, which was announced by the IFRS Foundation at 2021’s COP summit in Glasgow.

The move was hailed as a major step in the pursuit of a global census for climate disclosures.

In addition to the initial announcement, it was revealed that the ISSB would consolidate with the Climate Disclosure Standards Board (CDSB) and the Value Reporting Foundation (VRF) by June 2022, resulting in the formation of a new global standards setter. This consolidation has now been completed.

Crucially, the ISSB’s inception was also accompanied by the publication of prototype climate disclosure requirements. In March 2022, the ISSB replaced this with two fully-fledged exposure drafts, pledging to issue them for adoption in 2023.

“I commend the ISSB for the progress it has made since being established at COP 26,” Poole said.

“The Board membership has been finalised, the consolidation of leading sustainability-standards setters has been realised, and draft standards have been issued for consultation.”

This was echoed by IFRS Foundation chair Erkki Liikanen, who hailed the ISSB’s year-one milestones.

“A lot can happen in 12 months. One year on from the announced establishment of the ISSB at COP26, the board is now fully operational and committed to issuing its first two standards for adoption in 2023 following extensive global consultation this year,” he said in a statement.

“This suite of announcements at COP27 enables us to deliver on our commitment […] to provide the global financial markets with high-quality disclosures starting with climate.”