IFS director says OBR’s economic forecasts are ‘extraordinarily optimistic’

UK set to wait years before GDP returns to pre-pandemic levels

UK set to wait years before GDP returns to pre-pandemic levels

The Office for Budget Responsibility (OBR)’s “upside scenario” economic forecasts for UK GDP are “extraordinarily optimistic”, according to Paul Johnson director of the Institute for Fiscal Studies (IFS).

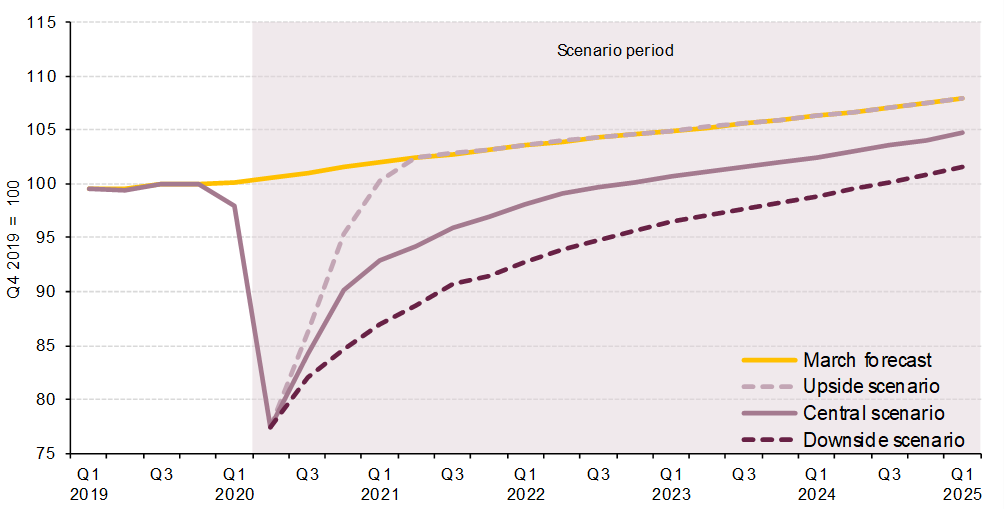

The OBR’s Fiscal Sustainability Report – July 2020 provides three potential scenarios for UK GDP over the next five years to reflect the different potential outcomes for the UK economy depending on how the coronavirus pandemic develops.

Source: Office for National Statistics, OBR

But Johnson has suggested that both the upside and central scenarios are far too optimistic about the UK’s growth potential. In the upside scenario, the UK could quickly return to the growth path that it was on and, from an economic viewpoint at least, the pandemic would be seen as a “bad dream”, albeit with higher levels of debt, Johnson said.

Johnson made the comments while speaking at the Institute for Chartered Accountants England and Wales (ICAEW) virtual conference on August 19.

“I think to have that as an upside scenario is extraordinarily optimistic. I don’t know anyone who thinks there’s any serious probability of us simply returning to our previous growth path. But the OBR’s central scenario still has us several percentage points below where we would have been by the end of this parliament.

“The future is not going to look as good as the upside scenario. And actually, we might be quite lucky to get away with the OBR’s central scenario, that is many years of the economy actually remaining below its previous path, and indeed remaining below where it was last year with all of the consequences that that brings,” he added.

While Johnson refused to comment further about the impact of Brexit, he did say that this was likely to have an added negative effect on the UK’s growth path.

However, in response to Johnson’s comments the OBR said: “These scenarios are intended to provide a plausible range of outcomes against which the implications for the public finances can be assessed, but there is no good basis for forming a judgement as to their relative likelihood. In particular, we would not claim that the central scenario is the most likely of all possible outcomes. The upside scenario is probably about the best that can be hoped for, but even worse outcomes than the downside scenario are certainly possible.”

The OBR was established in 2010 as part of the response to the global financial crisis of 2008. It was formed as an independent body to prevent the politicisation of economic forecasts, where governments could potentially be too optimistic about future finances. In 2019, an International Monetary Fund (IMF) review of the OBR said it should be considered as “best practice” and as a benchmark for other countries to follow.

Johnson also explained that the pandemic had caused the “biggest economic contraction in the history of the UK” with similar effects around the rest of the world and the country likely to see a contraction of around 10-15 percent of GDP but owing to the nature of the crisis, this was difficult to predict.