Where do AI and Blockchain fall in the future of accountancy?

The CEO of Float, Colin Hewitt, on the changing role of the accountant, the benefits of Blockchain, and how an AI bot is managing his calendar bookings

The CEO of Float, Colin Hewitt, on the changing role of the accountant, the benefits of Blockchain, and how an AI bot is managing his calendar bookings

The Budget is now behind us but leaves in its wake an feeling that, once again, technology is at the forefront of our minds as we make decisions about the future.

Among other announcements, chancellor Philip Hammond promised the introduction of a digital services tax for tech giants like Amazon and Google. While he insisted he would stay largely away from productivity and technology in his speech, cheers from his party saw him speak on a few upcoming initiatives.

Why is this important? Well, the accounting industry, like other sectors, must stay ahead of the curve when it comes to digital and technology. Falling behind is not an option for firms who want to stay competitive or even stay in business in the future.

Accountancy Age spoke to Colin Hewitt, founder and CEO of Float, a cashflow forecasting software provider for accounting tech from businesses like Xero, Quickbooks, and FreeAgent.

What we see is the role of the accountant becoming much more is this move to being a trusted adviser.

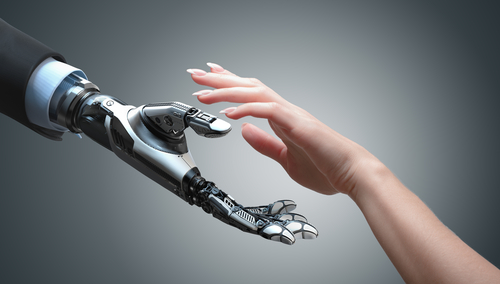

Hewitt explained that, with digital change comes physical change. It has already started happening, but accountants must expect their roles and day-to-day responsibilities to continue changing as technology evolves and creates less and less need for humans to spend time on mundane or admin-related jobs.

Hewitt said: “What we see is the role of the accountant becoming much more is this move to being a trusted adviser.

“Traditionally, accountants really struggled with forecasting – they may have done it once a year at most. However, new technology can enable the accountant and client to work together closely to bring that level of accurate forecast that used to be impossible.

“There will be far less time spent on activities like forecasting – it might be a ten minute chat once a month – and this paves the way for more interesting conversations like building a longer term financial model to raise money or advice about getting access to finance or a loan. It’s all the things accountants should be focusing on.”

But UK accountants should not worry about being replaced by robots. Not at all. Robots will take on automated activities, paving the way for accountants to focus more on relationships and advisory.

Hewitt said accountants “need to be thinking much more about account management, so they need to be considering their business in a growth way rather than a service offering.”

Accountancy now is really about “checking in with businesses and finding out what their needs are and how technology can be used to help those businesses grow. I think businesses are now looking for those sort of partners because they want this technology.”

Hewitt advised: “If I was running an accountancy firm right now I would definitely be looking for a relationship manager to be touching base with all my clients and finding out what their needs are and where they are struggling, and then finding out how we can help.”

He also pointed out that many businesses will choose accountants based on their training and qualifications in their software accreditation – so which accounting software company they are accredited in.

“It’s also about giving accountants the advice they need to help clients use the right technology to grow their business. This might be to do with taking credit card payments or invoice chasing software or access to single invoice finance cover.

“It is a technology play at the end of the day and if your accountant isn’t versed in that you may end up looking elsewhere.”

Talking of technology, AI is a scorching topic in accountancy as well as other industries at the moment.

That’s not just AI specifically used to help people succeed in their role as an accountant, but also the tools that improve people’s general productivity at work.

I think useful is often better than smart!

Hewitt explained: “I’m starting to use an AI bot to manage booking calendar appointments. So now if someone asks me for a meeting I can just copy in my virtual assistant, which is a robot, and they can find the time in my diary. That’s working really well. I think that’s a great example of how AI is saving time right away.”

“But I think in terms of accounting, we’re looking at the AI side to do things like predict trends and anomalies and become smart in when to alert our customers that there might be a problem so it’s something we’re taking a real interest in at the moment and thinking it doesn’t have to be super complicated it just has to be useful. I think useful is often better than smart!”

Blockchain is another area we are all talking about, but what lies in store for accountancy?

Hewitt said: “I think accountancy and Blockchain is really exciting because, certainly when you get into something like lending, it’s going to become a lot more peer-to-peer over the next few years where you might see one customer who needs money and another customer who’s willing to lend that, and bringing those two together in the marketplace is really exciting.

“Obviously there’s also making payments through technology like Ethereum where you can actually have smart contracts so you can say ‘when we have delivered this piece of work the payment will be executed automatically”.